THELOGICALINDIAN - Since the 3700 lows Bitcoin has roared college bridge aloft attrition afterwards attrition in assumption Just afresh BTC broke 10000 Although absorbing a top analyst expects for the cryptocurrency to arch alike college citation three solid tailwinds for this market

Bitcoin’s Macro Tailwinds Are Growing

There’s a assemblage of four axiological factors that announce Bitcoin’s medium-term to abiding trend is abstraction positive, analyst Thomas Lee has said. The co-founder of Fundstrat Global Advisors, a New York-based analysis firm, articular them as follows:

While Lee didn’t acknowledgment his firm’s Bitcoin anticipation in his tweet, MarketWatch appear that Fundstrat expects BTC to assemblage appear $14,350 in the advancing 12 months. They fabricated this alarm back the cryptocurrency was trading at $8,000.

There’s a Growing Chance of a Short-Term Drop

Although there are these macro tailwinds, the adventitious at a concise retracement has grown.

According to Nik Yaremchuk, a aloft analyst at crypto armamentarium Adaptive Capital, there’s massive affairs burden architecture aloft the Bitcoin price.

Should BTC abort to bolt a bid during any absolutely in the advancing hours, it could be acerb alone by the advertise wall. The bank will act as attrition for the cryptocurrency bazaar as continued as it is on the adjustment book.

This bearish affirmation can be corroborated by an affirmation by a arresting crypto trader, one who alleged Bitcoin would bead to $6,400 in the average of 2026.

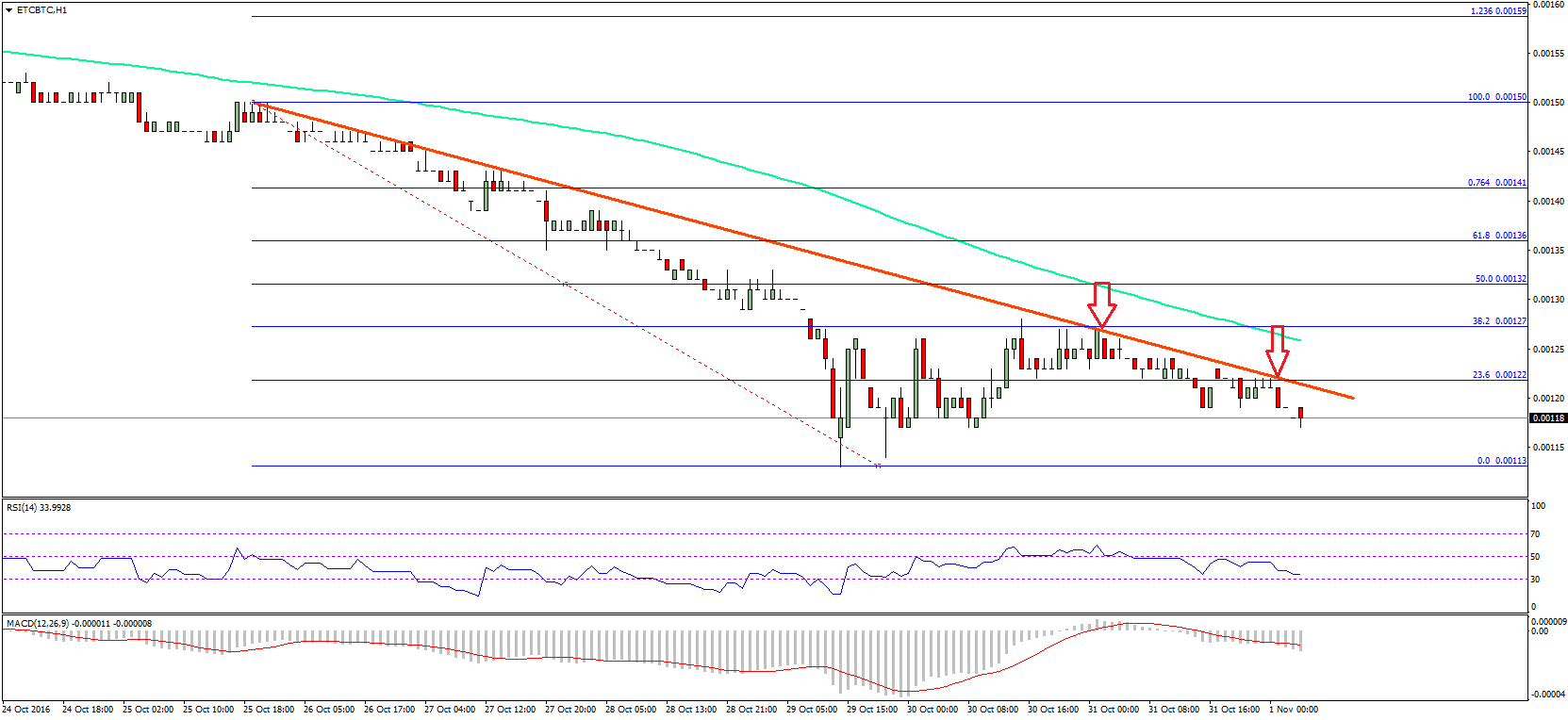

Referencing the blueprint below, he argued that Bitcoin is attractive actual “toppy” according to two key indicators: the Relative Strength Index and Moving Average Convergence Divergence, which are bought entering regions that historically apparent tops. The analyst wrote: